tax incentives for electric cars uk

RRP of eligible vehicles was reduced from 3500 to 32000. Tax for electric vehicles.

What S Put The Spark In Norway S Electric Car Revolution Motoring The Guardian

Benefit-in-kind tax for electric cars.

. Government grants as well as reductions in tax costs aim to make electric motoring more affordable. Electric av UK mix 0cc 0 litre EV400 S 90kWh 400PS Auto. The incentives include direct subsidies for the acquisition of new electric cars for up to 25 of the purchase price before tax to a maximum of 6000 per vehicle US8600 and 25 of the gross purchase price of other electric vehicles such as buses and vans with a maximum of 15000 or 30000 depending on the range and type of.

Car fuel benefit charge. Pay out of your Salary before Tax. New car buyers could previously get a 2500 discount on a new car with PICG but now the cap has been reduced to 1500.

Dealer must disclose to buyer the MSRP of the vehicle the applicable tax credit amount and the amount of any other available incentive applicable to the purchase. With the Plug-in Car Grant buyers can receive up to. However from April 2021 the Government will apply a nil rate for tax to zero.

Lets explore the EV incentives available in the UK. Traditionally employers have been able to offer company cars as an added benefit when attracting new employees. Ad Also Includes Tax Expiry Mot Details Etc.

The cheapest way to lease an electric car. Previously Plug-in Car Grant levels provided up to 1500 off the cost of a new Category 1 model essentially pure-electric models or range-extended EVs meeting the criteria for models costing up to 32000. Petrol 2998cc 3 litre 540i xDrive M Sport.

Plug-in hybrid electric vehicles PHEVs have reduced rates but some VED is payable depending on emissions. The UK governments Plug-In Car Grant PICG currently offers 2500 off the cost of an electric car but only for vehicles costing less than 35000. Calculate your Tax Savings today.

With the Plug-in Car Grant buyers can receive up to. PICG grant changes. Ad Discover the full Citroen range New and Used Citroen car deals on flexible finance plans.

Finally if used as company cars electric vehicles and vehicles emitting less than 60g CO2km do not pay tax. As more people than ever opt for electric vehicles. So you wont be saving 7500 on the 120990 Tesla Model X but you may still see savings on.

Official Citroën dealerships in Blackburn Bolton and Skelmersdale from the Chorley Group. Page 377 line 4 Dealer can apply credit at time of sale. There is no taxable benefit at all if the van is only used for business journeys and ordinary.

The act would extend 7500 in tax credits to EV owners but puts a cap on. Plus there are financial incentives available now to help drivers reduce the price of an EV. The taxable benefit for having the private use of a zero-emission van was reduced to zero in April 2021.

For 2019-20 low emission cars up to 50gkm are taxed at 16 of list price or 20 for diesels. Check Your Tax On Your Car Motorcycle Or Other Vehicle Using The Dedicated Page Provided. For a plug-in hybrid electric vehicle PHEV the incentive is 2500.

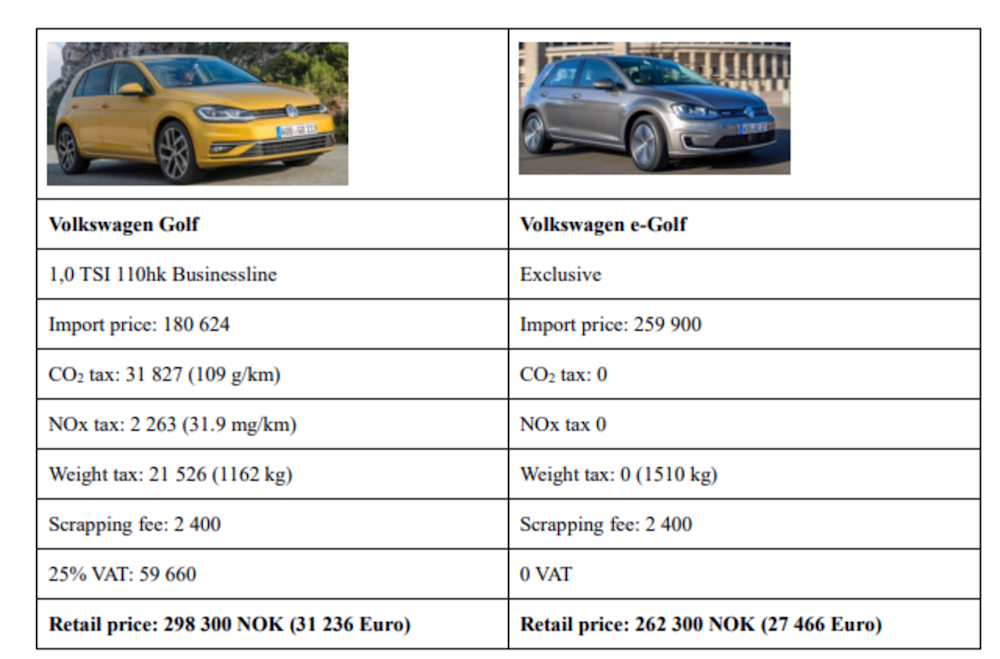

There are also tax-exemption benefits on Registration Tax and VED Road Tax for zero emission vehicles and reduced tax for plug-in hybrid. 2 days agoElectric vehicle EV owners could reap the benefits from the stunning deal on climate change and healthcare reached last week between Senator Joe Manchin and Senate Majority Leader Chuck Schumer in order to fight inflation the Inflation Reduction Act of 2022. 35 of the cost of an electric car up to a maximum of 3000 depending on the model 20 of the cost of an electric motorcycle or moped up to a max.

Ad Save by leasing any Electric Car through your Company. EV Incentives in the UK. The price cap for new electric cars is 55000 while the cap for new trucks and SUVs is 80000.

300 million in grant funding for sales of electric vans taxis and motorcycles to boost drive to net zero. 55k for all other vehicles. Electric vehicle incentives in Germany.

24100 Van benefit-in-kind tax charge. The average petrol or diesel vehicle has a BiK rate of 20 to 37 percent. Incentives did exist for consumer-facing plug-in cars in the UK but as of 14 June 2022 theyve been discontinued.

Are There Tax Incentives For Electric Cars In The United Kingdom. We Are the Uks Leading Supplier of Electric Vehicle Charging Cables Accessories. In 2020-21 the electric van was taxed at 80 of the benefit for a normal van which was 3490.

The number of electric cars registered in the UK as of the end of March 2021 was more than 495000 plug-in vehicles with approx. The rates for all 100 electric vehicles are now 0 and this will apply until at least 2025. 100 First Year Allowance FYA First Year Allowance is claimable for up to 100 of the cost of qualifying low emission and electric cars.

A further incentive to investing in an e-vehicle is the road tax payable Vehicle Excise Duty VED. Ad The UKs Largest Supplier Of Electric Vehicle Chargers Cables. Benefit in Kind Company Car Tax Rules Review of WLTP and Vehicle Taxes Budget 2020.

Other incentives for switching to electric vehicles Vehicle Excise Duty. 655 The tax charge for zero-emission vans increases in 2020-2021 to 80 from 60 of the main rate. Close to 13 billion in plug-in vehicle grant funding to bring ultra-low emission.

One of the most important incentives for private vehicle owners to go electric is to take advantage of the Plug-In Car Grant which covers up to 2500 of the cars purchase price depending on the model. Back in late 2021 the government made some changes to how the Plug-in Car Grant works. MSRP of vehicle must be 80k or less for SUVs Vans and Trucks.

10 of total car sales are made up of alternatively fuelled vehicles. So the charge was 2792. In Germany electric vehicles are exempt from the annual road tax for ten years after registration.

235000 BEVs and 260000 PHEVs registered. 35 of the cost of an electric car up to a maximum of 3000 depending on the model 20 of the cost of an electric motorcycle or moped up to a max. Every pure electric vehicle costing less than 40000 is.

Check whether you need to pay tax on an electric car used by your employee and find out if your employee is eligible for tax relief Check if you need to pay tax for charging an employees. The Democrats Inflation Reduction Act of 2022 would get rid of the 200000-vehicle limit that stops popular brands from giving EV tax credits with the 7500 incentives extended through 2032. However there have been significant reductions in this charge from April 2020 with electric-only cars falling to 0 in 2020-21 as well as reductions for electric hybrids depending on their electric-only range.

3430 Van fuel benefit charge. However former incentives were responsible for leapfrogging UKs plug-in car market to its current mature stage. Lets explore the EV incentives available in the UK.

The Tax Benefits Of Electric Vehicles Saffery Champness

Which Governments Are Promoting Electric Vehicles The Most

Comparison Of Leading Electric Vehicle Policy And Deployment In Europe International Council On Clean Transportation

Electric Cars The Surge Begins Forbes Wheels

Ev Ev Charger Incentives In Europe A Complete Guide For Businesses Individuals

The Tax Benefits Of Electric Vehicles Saffery Champness

Which Governments Are Promoting Electric Vehicles The Most

A Complete Guide To Ev Ev Charging Incentives In The Uk

Electric Vehicles As An Example Of A Market Failure

Ev Tax Credit Plan Draws Ire From Non Union Toyota Tesla Bloomberg

Road Tax Company Tax Benefits On Electric Cars Edf

Incentives To Buy An Electric Car Greencars

Ev Update Toyota Reaches Tax Credit Phaseout Gm Refunds Bolt Price Cuts To Current Owners

Why Electric Cars Are Only As Clean As Their Power Supply Electric Hybrid And Low Emission Cars The Guardian

Uk Further Cuts Down Plug In Car Grant Picg Electrive Com

Toyota Will Soon Max Out Its Electric Vehicle Tax Credits Marketwatch

Electric Vehicles Grants And Tax Benefits For Small Businesses Sage Advice United Kingdom

Today The 1 875 Federal Tax Credit For Gm Is Gone

Uk Ev Incentives And Support Progressive Thinking By Conservative Government